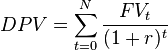

The stuff above the line in this fraction is the numerator and below the line the denominator. The V stands for value, Present or Future and r is the “rent” or interest rate. t is used to denote a specific time frame in an series of time frames from 1 to N where N can be infinite.

In economics it is a settled principal that the value of literally anything can be determined by this formula, albeit in a rather abstract way. You will notice immediately that when r, that is the interest rate, drops to zero the denominator approaches unity and consequently loses its purpose in the formula which then becomes PV=FVt for t,1 to n.

As 1 to n can be an infinite string of time periods the value of an income stream starts to approach infinity regardless of how small the income might be in each period. Human nature is such that we normally prefer gratification today above tomorrow. That is why interest rates are positive. By making them negative central banks around the world are, as it were, denying human nature. In the process they up the value of all assets which now seems to be the unstated goal. When yesterday the BOJ makes a surprise announcement that interest rates would be pushed to zero or in negative territory, the Nikkei 225 responded with a 872 point move between the low and the high of the day, or slightly more than 5%. Considering that a 10-year bond was already going for 1% ( for the whole ten years, not annually), the absurdity of it all becomes apparent (equities do in one single day what it takes government bonds to do in 50 years!). The Dow joined in with 400 points. The Dow and Nikkei have roughly the same numerical value!

It has been shown that the top 60 billionaires (Forbes listing) now have wealth in excess of what the bottom half 3.500.000.000 people on this earth have. To no small extent this is due to Central Bank policies. Income and wealth inequality have been proven to be significant precursors to economic downturns.